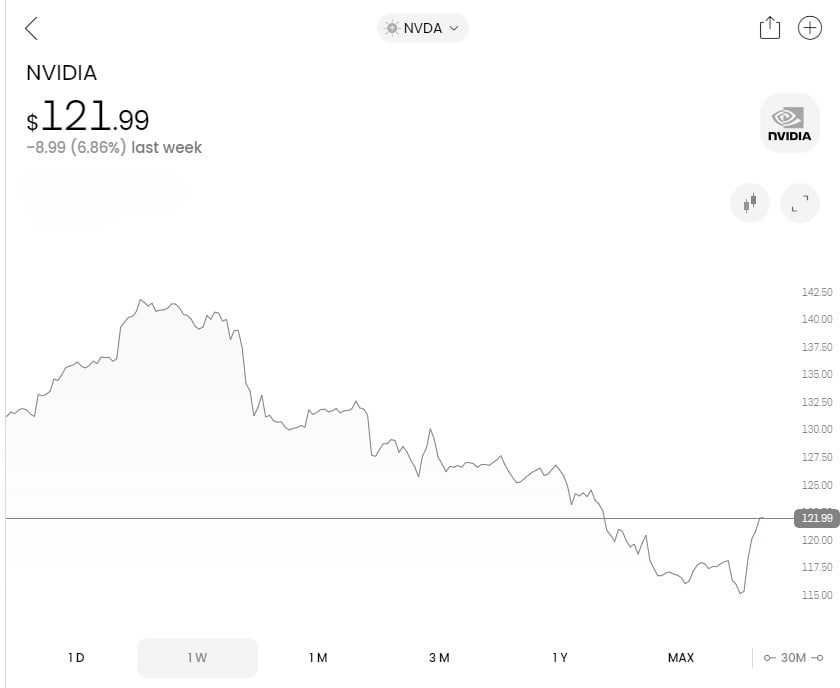

Nvidia, the semiconductor giant, has recently experienced a dramatic shift in its market value, shedding more than $500 billion (£433 billion) in market capitalisation. This sharp decline follows Nvidia’s brief moment as the world’s most valuable company, surpassing tech behemoths Apple and Microsoft. As shares fell nearly 7% on Monday and remained in the red during pre-trading hours, the company’s market cap has now dropped to $2.91 trillion (£2.29 trillion).

Profit-Taking Amid Meteoric Rise

The recent dip in Nvidia’s stock price is largely attributed to profit-taking by investors after a remarkable surge this year. David Morrison, senior market analyst at Trade Nation, commented on the situation: “Some profit-taking seems entirely reasonable given Nvidia’s meteoric rise. The stock was up over 180% this year alone. But if it continues to lose ground, then there’s a danger of contagion, with selling spreading to other big tech names. If that were the case, then the market could be in for a deeper and more protracted pull-back.”

Market Sentiment and CEO Stock Sales

Another factor weighing on Nvidia’s stock is CEO Jensen Huang’s recent stock sales through a trading plan, which has prompted concerns about the stock being overvalued. Richard Hunter, head of markets at Interactive Investor, noted: “The stellar rise of tech and AI-related stocks in particular inevitably gets to the stage where investors pause for breath and recalculate valuation levels.”

The Bigger Picture

Despite these concerns, there are few signs that investors are overly worried about a widespread sell-off. The rotation away from technology stocks did leave the S&P 500 slightly down by 0.3%, even though 70% of its constituents posted gains. Chris Weston, head of research for Pepperstone Group, emphasised, “People are working out now that momentum works both ways.”

As Nvidia navigates this volatile market phase, the semiconductor industry and broader tech sector will be closely watched by investors. The company’s future performance will likely hinge on its ability to sustain growth and investor confidence amidst these fluctuations.

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial advice. Investing in the stock or crypto (highly volatile) market involves risks, including the loss of principal. Past performance is not indicative of future results. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Further Reading