The start of the week saw European stocks opening in the red, driven by a mix of disappointing corporate news and geopolitical uncertainties. Leading the decline was luxury retailer Burberry (BRBY.L), which announced significant corporate changes and suspended its dividend, dragging down London’s FTSE 100 index.

Burberry’s Troubles Impact FTSE 100

The FTSE 100 (^FTSE) fell by 0.7% in early trading, with Burberry losing over 10% of its value immediately after the opening bell. By the afternoon, the FTSE was down by 0.8%. The retailer’s disappointing profit reports for the first financial quarter led to the ousting of its CEO and the suspension of its dividend, marking one of the company’s toughest days in recent history.

Chris Beauchamp, chief market analyst at IG, noted, “Burberry’s results today were dire, and the shares have reacted with a 16% drop to 14-year lows. The read-across has caught two very different sectors, retailers and mining. Retailers are hit by concerns that Burberry’s woes indicate a broader issue with UK consumer spending, while miners are affected by poor Chinese GDP figures.”

European Markets Follow Suit

The decline was not isolated to the UK. Germany’s DAX (^GDAXI) fell by 0.8%, and France’s CAC (^FCHI) dropped by 1.2%. The pan-European STOXX 600 (^STOXX) was down 1%, following the trend set by Asian markets after disappointing Chinese GDP data.

US Markets Rally Despite Assassination Attempt

In contrast, US markets experienced a rally. The S&P 500 (^GSPC) rose by 0.9%, the Dow (^DJI) increased by 0.8%, and the Nasdaq (^IXIC) jumped 1.2%. This rally occurred as traders processed the news of an apparent assassination attempt on presidential hopeful Donald Trump over the weekend, followed by a speech from Federal Reserve Chair Jerome Powell.

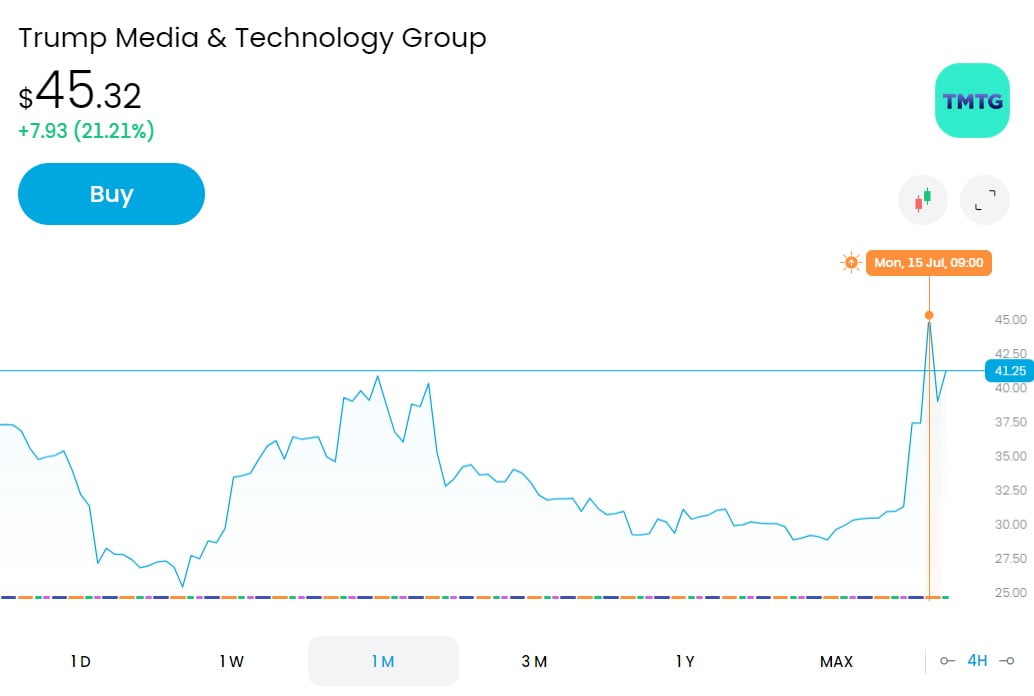

Market sentiment seemed to pivot on the belief that a Trump victory in the upcoming presidential election could lead to looser fiscal policies, higher tariffs on overseas goods, and a more favourable environment for tech and media companies. Trump Media & Technology Group (DJT) saw its shares skyrocket by nearly 70% in pre-market trading.

Charu Chanana, market strategist at Saxo Capital Markets, remarked, “With markets pricing in a greater possibility of Trump 2.0, the US dollar will likely get some tailwinds while the Mexican peso and Chinese yuan could suffer. Trump trades could be back in focus.”

Impact on Global Currencies and Commodities

Mark McCormick of Toronto Dominion Bank commented on the broader market implications: “For us, the news does reinforce that Trump’s the frontrunner. We remain US dollar bulls for the second half and early 2025.”

Bitcoin also experienced a significant uptick, rising by almost 5% to trade above $63,000 for the first time in two weeks. Neil Wilson, chief market analyst at Finalto, attributed this to both fear trade dynamics and Trump’s perceived pro-crypto stance.

Looking Ahead

The contrasting performances of European and US markets underscore the current volatility driven by both corporate developments and geopolitical events. As the week progresses, investors will closely monitor the fallout from Burberry’s announcement and the ongoing political developments in the US, particularly any further statements or actions from Donald Trump.

Further Reading