In what’s being described as the most formidable housing market in nearly seven decades, first-time buyers are finding themselves increasingly side-lined. With mortgage rates climbing and rents surging, the dream of owning a home is becoming more elusive for many.

The Financial Balancing Act

Today, securing a foothold in the property ladder is not just a matter of saving for a hefty deposit but also managing soaring ongoing costs. As per the latest report by the Building Societies Association (BSA), first-time buyers often need dual high incomes or substantial parental backing to afford their initial purchase. The economic landscape, underscored by a stark rise in living costs, has tightened the vise around potential homeowners.

Rising Costs and Stagnant Wages

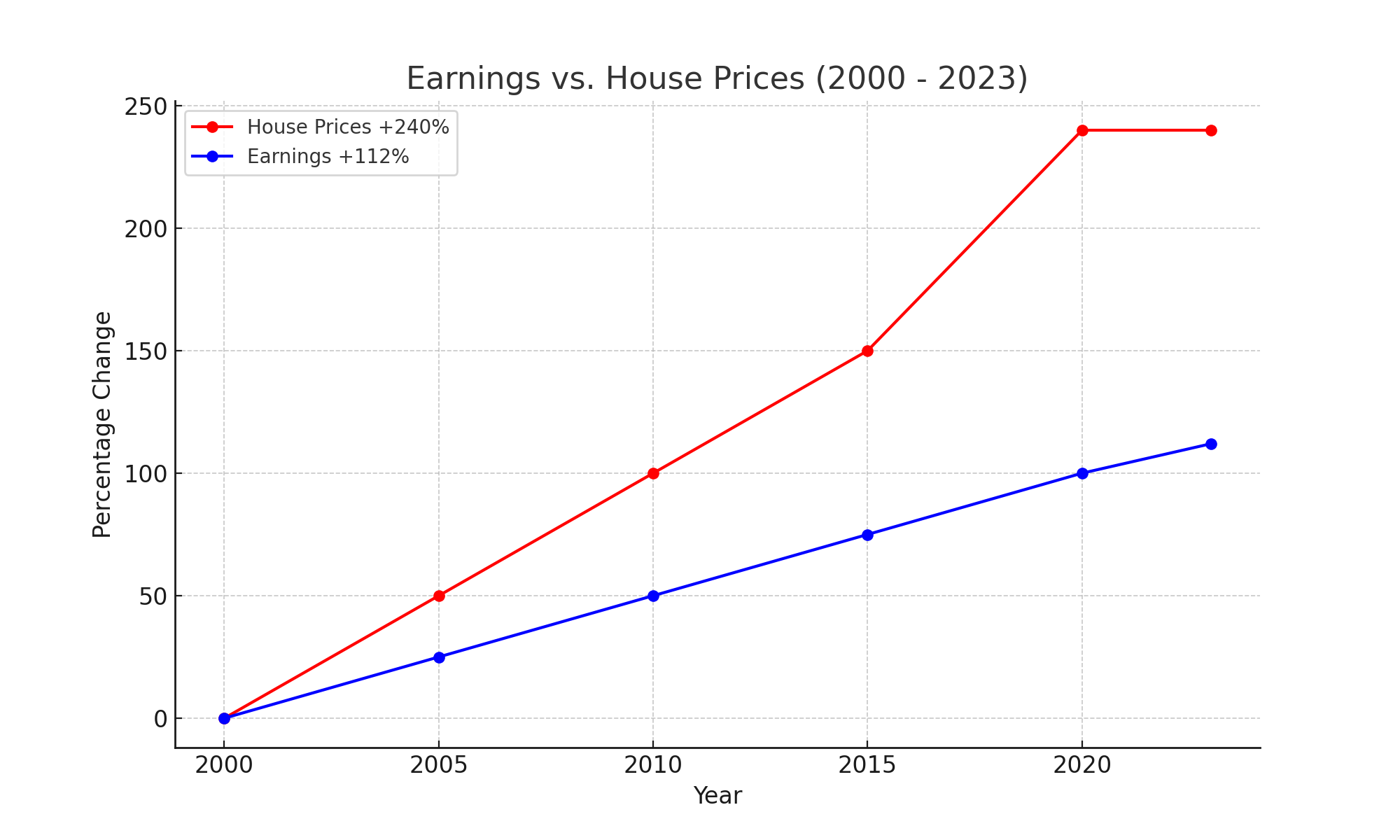

The BSA’s findings align with broader economic data indicating that house prices have continued to outstrip wage growth significantly. This imbalance has made the initial steps onto the property ladder daunting, if not unattainable, for many. The UK’s private rental sector has seen a staggering 9.2% increase in costs over the past year alone, adding to the financial strain on those saving to buy.

Beyond the Numbers

The personal stories at the heart of this crisis bring the statistics into sharp relief. For residents in sought-after areas, the influx of investment from affluent buyers and property speculators has escalated housing costs dramatically. This trend has left local prospective homeowners grappling with a market that often feels beyond reach. ‘It’s becoming increasingly challenging for people who grew up in the community to afford a home where their roots are,’ shares a Cotswolds local.

A Call for Change

Experts argue that addressing this issue requires more than piecemeal reforms; it demands a radical rethinking of housing policies. Proposals range from increasing the flexibility of mortgage requirements to extending mortgage terms, which could make monthly payments more manageable.

Imagining a New Path Forward

Innovative solutions such as shared ownership schemes, where buyers can purchase a portion of a property to ease financial burdens, are also being touted as part of the solution. Moreover, there’s a growing advocacy for government-led initiatives that review and revamp the first-time buyer market to create a more inclusive and accessible housing system.

Conclusion

As the housing market continues to evolve, the need for substantial policy intervention becomes increasingly apparent. Without it, the dream of homeownership will drift further away for the next generation, altering the very fabric of society. It’s a pivotal moment for policymakers, industry leaders, and communities to come together to ensure that everyone has a fair chance at the cornerstone of financial security and personal achievement: owning a home.