The latest valuation of Elon Musk’s SpaceX at $210 billion (£161 billion) has breathed new life into Edinburgh Worldwide Investment Trust, offering a glimmer of hope for its shareholders after a tumultuous three years. This $587 million investment trust, a counterpart to the renowned Scottish Mortgage Trust managed by Baillie Gifford, focuses on identifying and investing in young, innovative companies with long-term growth potential.

Revival Amidst Market Volatility

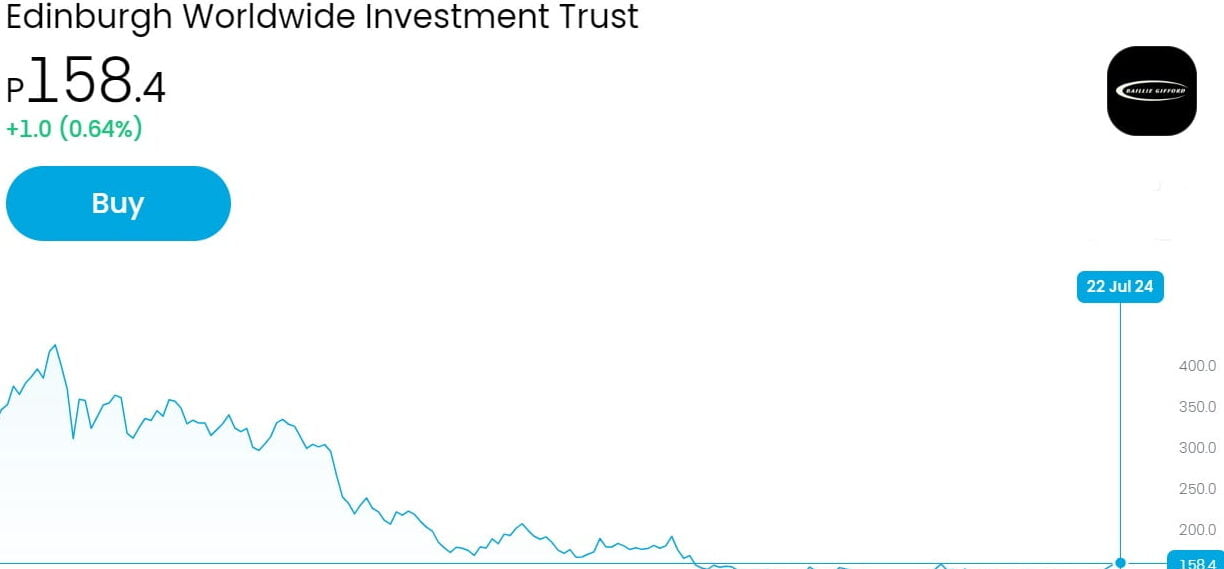

Edinburgh Worldwide, like its larger sibling Scottish Mortgage, has had a wild ride over the past five years. The fund, which is heavily weighted towards technology and growth-oriented start-ups, saw its shares soar from 215p in February 2020 to a peak of 417p a year later, thanks to the internet surge during COVID-19 lockdowns. However, the shares plummeted to a six-and-a-half-year low of 122p last October due to soaring inflation and interest rates.

With inflation easing and interest rates peaking, the shares have partially recovered to 155p, buoyed by positive news from its core holdings. The valuation boost from SpaceX, which constitutes 11.8% of the trust’s portfolio, has played a significant role in this recovery. SpaceX’s success, particularly its recent share buyback at $112 per share, has reassured investors of the valuation’s accuracy and the potential for future growth.

Strategic Investments and Portfolio Highlights

The trust’s focus on early-stage, high-growth companies in sectors like computing, transport, and healthcare reflects its commitment to long-term value creation. Despite a diversified portfolio of 95 stocks, the top 10 holdings account for 42% of its assets, showcasing the high-conviction nature of the fund.

SpaceX’s re-evaluation underscores its dominance in the rapidly expanding space sector, with 96 rocket launches last year and a thriving Starlink satellite communications business. The potential IPO of Starlink could further boost the trust’s returns.

Other notable holdings include Axon Enterprises, the maker of Taser devices, and AeroVironment, a military drone manufacturer, both of which have seen significant gains. However, setbacks at companies like Ocado, Oxford Nanopore, and Graphcore highlight the risks inherent in high-growth investing.

Positive Financial Performance and Investor Sentiment

The trust’s half-year results showed a 4.6% underlying return, a positive outcome after significant losses in the previous two years. The shares performed even better, returning 13.6% on hopes of a turnaround, bolstered by strong performances from core holdings.

The involvement of US hedge fund Saba Capital, which holds a 16% stake, has further boosted investor confidence. Saba’s strategic buying and the narrowing discount to net asset value suggest that the trust may offer attractive returns going forward.

Outlook and Recommendations

While the broader market anticipates only modest interest rate cuts, the outlook for Edinburgh Worldwide has improved. The fund managers’ ongoing search for the next “Magnificent Seven” of the tech world remains a compelling investment thesis. However, investors should balance their exposure to Baillie Gifford’s high-growth funds, particularly if they already hold Scottish Mortgage.

Overall, the recent developments and strategic investments justify a positive outlook for Edinburgh Worldwide Investment Trust. Investors looking for exposure to innovative, high-growth companies may find this trust an attractive option.

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial advice. Investing in the stock or crypto (highly volatile) market involves risks, including the loss of principal. Past performance is not indicative of future results. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Further Reading